Renaissance Technologies and using algorithms to beat the stock market for decades

From codebreaking to finance - how Jim Simons and RenTech paired algorithms like the Hidden Markov Model with a culture of academic innovation to build the highest performing fund in history.

Welcome to Day to Data - a dose of musings by a data scientist turned venture investor, breaking down technical topics and themes in data science, artificial intelligence, and more. Check out the last piece here. New post every other Sunday.

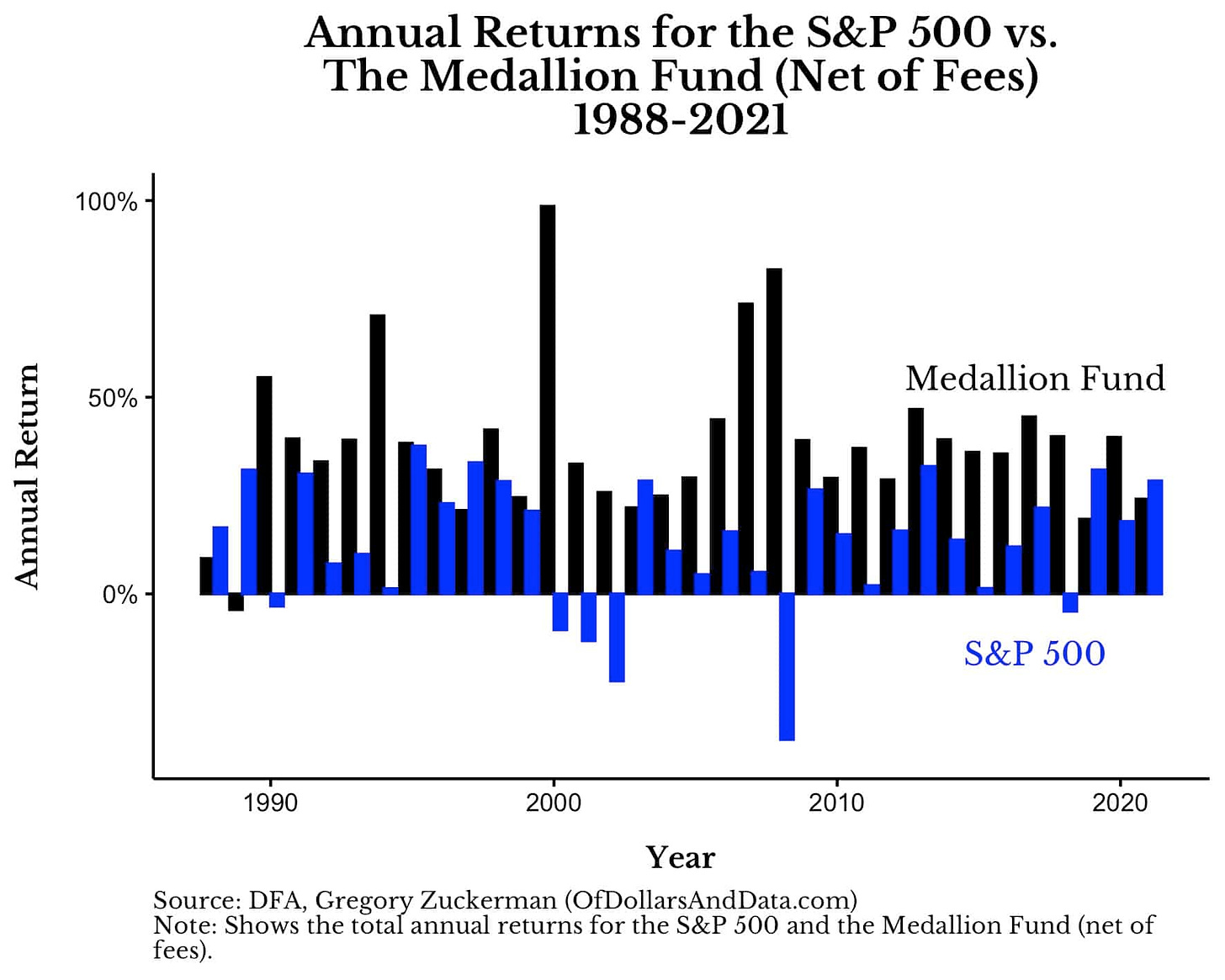

Last week, I devoured the latest episode of Acquired (which is my favorite podcast these days) on Renaissance Technologies. Ever heard of them? Well, if you haven’t, it’s not surprising, but you’re going to be intrigued. Per their website, Renaissance Technologies (also known as RenTech) is “an investment management firm that employs mathematical and statistical methods in the design and execution of its investment programs”. RenTech is known best for returning more than 66% annualized before fees over 1988-2018 in their Medallion fund, which is closed to outside investors. In 2020, per Acquired, they had gross returns of 149%.

Today, we’re talking about the academic brain power at RenTech and the algorithms that can understand markets better than humans.

This article is for informational purposes only. This is not investment advice.

A finance team that’s never worked in finance

If RenTech was looking to hire a new employee, they would not go looking to the big banks in Midtown Manhattan. RenTech has made a name for themselves by being an academic-focused financial institution. Employees have PhD’s in mathematics and computer science, and are ready to work on massive algorithms versus complex Excel models. This focus on academics comes from the background of founder Jim Simons. After getting a math degree from MIT and a PhD at Berkeley, he led the math department at State University of New York at Stony Brook - an important detail when wondering why RenTech is based in the seemingly obscure town of East Setauket, NY.

Simons also spent the 1960s at the NSA as a codebreaker during the Vietnam War. During this time at the NSA, the group Simons was a part of had a simple mandate - spend 50% of your time on codebreaking and you are free to use the other 50% of your time on academics, publishing research, or other initiatives. Per Acquired, Simons, alongside some other brilliant colleagues he had recruited, used his remaining time to apply technical learnings from codebreaking to a new medium - trading stocks.

Using algorithms to understand the hidden patterns of stock markets

Simons and other researchers were using the Baum-Welch algorithm to determine the parameters of Hidden Markov Models (HMMs) which could be applied to historical financial data. HMMs are a statistical model that attempts to describe a sequence of events (or states) which depend on underlying sequences of “hidden” events. Essentially, HMMs are trying to make sense of patterns that are not understandable to the eye - much like what happens in our financial markets every day.

Sounds like magic! In finance, HMMs are used to capture “hidden” signals or patterns in financial data. This work eventually inspired the starting of his fund, Monemetrics, which was later renamed to Renaissance Technologies. RenTech focuses on building models like HMMs that remove the human elements of making financial decisions. Simons once told the WSJ that “I don’t want to have to worry about the market every minute. I want models that will make money while I sleep.”

Want to nerd out? This lecture from the University of Luxembourg was a good read to get up to speed on HMMs and stock trading.

A culture where research drives innovation

This culture of research has been a pinnacle of the firm, and shows no signs of slowing down. In 2014, a patent was quietly filed by Robert Mercer and Peter Brown, once co-CEOs of RenTech, for a system and method for executing synchronized traders in multiple exchanges. The abstract reads:

A financial trading system that includes a trading server, multiple financial exchanges, and multiple servers with each server associated with and co-located at an exchange and comprising a high accuracy clock. The trading server divides a large transaction order into multiple smaller transaction orders and combines each smaller transaction order with a transaction execution time. The trading server sends a financial trade instruction based on each combined smaller transaction order and transaction execution time to each co-located server. When the high accuracy clock on each server reaches the transaction execution time, all the servers submit their smaller transaction orders to the respective financial exchanges substantially simultaneously.

I haven’t read a patent as in-depth in a while as I have read this one. Prior technology required the use of clunky fiber optic cables and other complex circuitry to communicate and control the execution of trades. In order for trades to execute across several exchanges at the same time, the cables would try to delay the data moving to faster exchanges so that all trades executed at the same time regardless of speed to transfer information. The system described in the patent is a computer-based method that takes a large transaction order, divides it into a smaller set of transactions, and then determines the times at which all trades must be executed at separate institutions. While much of what RenTech does appears to be different than traditional high frequency trading (HFT) funds, this patent shows they are continuing to innovate the ways that they can execute trades faster and more efficiently than their counterparts.

Their focus on innovation shows in their performance. As mentioned, their flagship fund - the Medallion Fund - returned more than 66% annualized before fees over 1988-2018, and is closed to outside investors. Their model has performed best in the most volatile of times for the rest of the market (see late 1990s and 2008 below).

As more and more trading strategies get commoditized, there will continue to be innovation that moves further down the stack - meaning closer to the data, the circuits, and the hardware that are enabling our financial infrastructure.

Beyond the fund

Jim Simons is continuing to innovate even after stepping down from the CEO role at RenTech in 2010. In 2012, he established the Simons Institute for the Theory of Computing at his alma mater UC Berkeley. In 2016, he established the Flatiron Institute in Manhattan to house over 60 researchers working towards innovations in computational science. In a rare interview with the New Yorker, Simons spoke about the Flatiron Institute, where he seemingly hopes to replicate the academic culture of RenTech to be applied to areas outside of just finance.

Lastly, for your (and my own!) future reading, The Man Who Solved the Market by Gregory Zuckerman of the WSJ, published in 2019 alongside this article, details the secretive and fascinating life of Simons — or apparently as close as one has managed to get. The firm continues to be an elusive place, far out of the city, where few will ever know exactly what’s happening behind closed doors. One lingering thought after all this is…. those must be some complex taxes.

Thanks for tuning in! See you back here in two weeks. If you’ve been enjoying Day to Data, let a friend know! You can find me on Twitter/X at @gabyllorenzi.